Unlocking Opportunities: The Ultimate Guide to Forex Trading Platforms

In the ever-evolving world of finance, forex trading platforms serve as the gateway for traders to engage in the forex market. These platforms, equipped with a plethora of tools and resources, play a crucial role in determining the success of trading endeavors. Choosing the right platform is paramount, and in this article, we will delve into the various aspects that you need to consider. For those looking to explore options in Southeast Asia, you can visit forex trading platform Forex Brokers in Indonesia for insights on local trading opportunities.

Understanding Forex Trading Platforms

A forex trading platform is a software application that allows traders to buy and sell currencies. These platforms can be web-based or downloadable applications that enable trading via desktop, mobile, or tablets.

They provide access to the forex market and offer various functionalities such as real-time price quotes, analytical tools, charts, and order management systems.

Some of the most popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Essential Features of Forex Trading Platforms

When selecting a forex trading platform, several key features should be taken into account:

User Interface

A user-friendly interface is crucial for a positive trading experience. The layout should be intuitive, allowing traders to navigate easily without overwhelming them with information. Look for platforms that allow customization to fit your specific trading style.

Technical Analysis Tools

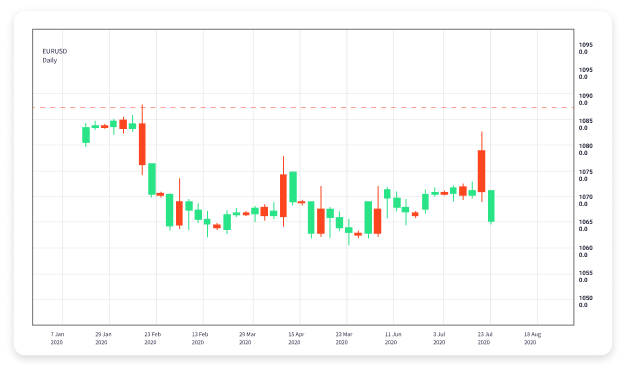

Access to robust technical analysis tools is vital for traders who rely on charting and technical indicators. Good platforms offer a variety of indicators and drawing tools that help in making informed decisions.

Execution Speed

Speed is critical in currency trading. The ability to execute trades instantly can make a significant difference, especially in volatile markets. Choose a platform known for its fast order execution and minimal slippage.

Mobile Trading Capability

In today’s fast-paced environment, mobile trading has become essential. Ensure your chosen platform offers a reliable mobile application, allowing you to manage trades on the go.

Customer Support

Reliable customer support can help resolve issues quickly. Look for platforms that offer multi-channel support, including phone, email, and live chat options.

Types of Forex Trading Platforms

Forex trading platforms can be broadly categorized into three types:

Broker Platforms

Many brokers develop their trading platforms tailored to their services. These might include features specific to their unique offerings but may lack the advanced tools available in third-party platforms.

MetaTrader Platforms

MetaTrader 4 and MetaTrader 5 are the most popular platforms among forex traders. They offer extensive customization, automation through Expert Advisors (EAs), and a large community for sharing ideas and strategies.

Web-Based Platforms

Web-based platforms provide convenience, as they are accessible from any device with internet access without the need for downloads. They are ideal for traders who prefer not to install applications.

Regulations and Security

Security is paramount when it comes to online trading. It’s essential to choose a platform regulated by a reputable authority. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce strict guidelines to protect traders. Always ensure that the platform you select employs strong encryption methods and has a favorable track record of safety.

Fees and Spreads

Different forex trading platforms have varying fee structures. Understanding the costs is crucial to effective trading.

Look for platforms with low spreads and reasonable commission fees, and be wary of hidden charges that may erode your profits.

Some brokers offer zero commission trades but may offset that with wider spreads.

Practice Accounts

Many platforms offer demo accounts for traders to practice trading without risking real money.

This is an excellent opportunity for beginners to familiarize themselves with the platform’s interface and to develop trading strategies before committing real funds.

Conclusion

Choosing the right forex trading platform is a critical step in your trading journey. Evaluate your needs, and consider factors like user experience, analytical tools, execution speed, and security before deciding.

Whether you are a beginner or a seasoned trader, taking the time to research different platforms will pay off in the long run, helping you make more informed trading decisions and ultimately improving your success in the forex market.

In summary, forex trading platforms are an essential tool for forex traders. With a myriad of options available, it’s crucial to assess your individual trading needs and preferences. Keep in mind that the right platform can make a significant difference in your trading experience, influencing everything from speed and ease of use to the availability of crucial analytical tools.